Conducting an I-9 self-audit is a proactive measure that your business can take to ensure compliance with employment eligibility verification regulations in the United States and can help protect with the following:

- Legal Compliance: Ensure that all I-9 forms are accurately completed and maintained. Failing to properly complete and retain I-9 forms can result in fines and penalties for your businesses. Conducting a self-audit helps identify any errors or deficiencies in the forms and allows your business to rectify them before they become serious issues during government audits.

- Training and Education: Self-audits can help identify areas where employees responsible for completing I-9 forms may need additional training and education. This can help reduce errors and ensure that all staff members understand the importance of proper I-9 compliance.

Before conducting an audit, your leadership should consider the purpose and scope of the audit and how you will communicate information to employees, such as the reasons for the internal audit and what employees can expect from the process.

At Achilles Group, we have the expertise and provide clients with guidance and training on proper Form I-9 practices and how to perform and track a self-audit. If you are not already an Achilles client and would like more information on protecting your business with best HR practices, contact us for more information at 281-469-1800 or through our website at www.achillesgroup.com.

What is Form I-9?

An I-9 Form, also known as the Employment Eligibility Verification Form, is a document used in the United States to verify the identity and employment authorization of individuals hired for employment. It’s a requirement for all employers in the U.S. to complete an I-9 for each employee they hire, including citizens and noncitizens.

The form requires employees to provide specific documents that establish their identity and work authorization, such as a U.S. passport, driver’s license, Social Security card, or other acceptable forms of documentation. Employers are responsible for examining these documents to verify their authenticity.

The I-9 serves as a crucial part of your business’ compliance with U.S. immigration and labor laws. Failure to properly complete and maintain I-9 Forms can result in penalties and legal consequences.

Recordkeeping

Retaining the Form I-9

- Keep your Form I-9s separate from the Personnel Files

- Keep your terminated employees’ Form I-9s separate from the current employee Form I-9s, and purge according to retention requirements.

Tracking Future Expiration Dates

- Create an Excel Spreadsheet for Tracking that is checked on a monthly basis.

or

- Add the document’s expiration date to your calendar as a reminder (preferably a month or so in advance)

How long must I keep a Form I-9?

- You must retain a Form I-9 for all current employees and for a certain amount of time after they stop working for you.

- Three (3) years after the date of hire, or one (1) year after the date employment ends, whichever is later.

What happens if your business is not compliant with the I-9 forms and practices:

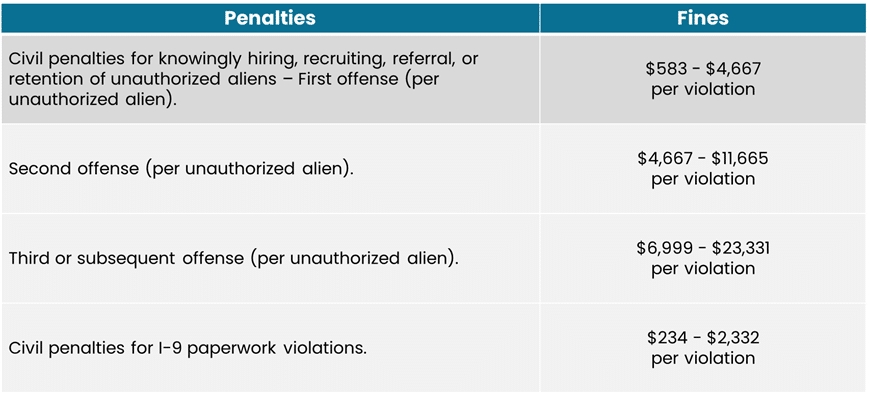

When a business is not compliant with I-9 forms or practices, it can face a range of legal and financial consequences. The U.S. government takes employment eligibility verification seriously, and businesses that fail to adhere to I-9 requirements can be subject to various penalties and sanctions. Here are some potential consequences:

- Penalties & Fines

- Disqualification from Government Contracts: Businesses that are found to be non-compliant with I-9 requirements can be disqualified from obtaining or renewing government contracts.

- Employee Complaints: Employees may file complaints if they believe that their rights have been violated due to I-9 non-compliance. These complaints can trigger government investigations and audits.

- Criminal Charges: In extreme cases of deliberate and widespread non-compliance, business owners or responsible individuals could face criminal charges related to document fraud or knowingly employing unauthorized workers.

Performing periodic self-audits of I-9 records will help protect what you have worked diligently to build and grow as a business owner and leader. Although this task may seem tedious, it’s a proactive measure that can prevent future headaches and profits from draining out of your organization.